Commercial property insurance plays a crucial role in safeguarding businesses against potential risks and losses associated with their physical assets. From office buildings to retail spaces, warehouses, and manufacturing plants, commercial property insurance provides financial protection for property damage, theft, natural disasters, and other unforeseen events. In this article, we will explore the best commercial property insurance options available in America to help businesses make informed decisions in protecting their valuable assets.

Table of Contents

- Understanding Commercial Property Insurance

- Factors to Consider When Choosing Commercial Property Insurance

- Top Commercial Property Insurance Companies in America

- Comparison of Coverage and Benefits

- Tips for Obtaining the Best Commercial Property Insurance

- Common FAQs about Commercial Property Insurance

1. Understanding Commercial Property Insurance

Commercial property insurance is designed to protect business owners from the financial impact of property damage or loss caused by fire, theft, vandalism, natural disasters, or other covered perils. It covers not only the physical structure but also the contents within the building, such as equipment, inventory, furniture, and fixtures. Having the right commercial property insurance policy ensures that businesses can quickly recover and resume operations in the event of an unforeseen incident.

2. Factors to Consider When Choosing Commercial Property Insurance

When selecting commercial property insurance, several factors should be taken into consideration:

- Property Valuation: Ensure that the policy covers the full value of your property and its contents.

- Coverage Options: Evaluate the range of coverage options available, including property damage, theft, business interruption, and liability.

- Deductibles and Premiums: Consider the deductibles and premiums associated with different insurance policies and determine what is affordable for your business.

- Additional Coverage: Assess whether additional coverage options, such as flood insurance or equipment breakdown coverage, are necessary for your specific business needs.

- Policy Exclusions: Understand the exclusions and limitations of the insurance policy to avoid any surprises during a claim.

3. Top Commercial Property Insurance Companies in America

- Best for Self-Employed Businesses: Next Insurance

- Best General Liability: Chubb

- Best Commercial Property: The Hartford

- Best Commercial Auto: Progressive

- Best for Availability: Nationwide

- Best Business Owner’s Policy: Berkshire Hathaway

- Best Liquor Liability: Insureon

These companies have established a strong reputation for providing reliable and comprehensive commercial property insurance coverage. It is advisable to research and compare the offerings of these companies to find the best fit for your business.

4. Comparison of Coverage and Benefits

To determine the best commercial property insurance for your business, it is essential to compare coverage and benefits offered by different insurance providers. Factors to consider during the comparison include:

- Coverage limits for property damage and theft

- Business interruption coverage

- Liability coverage

- Additional coverage options

- Claims process and customer support

By carefully assessing these factors, businesses can identify the insurance policy that provides the most comprehensive coverage and aligns with their specific needs.

5. Tips for Obtaining the Best Commercial Property Insurance

Here are some tips to help businesses obtain the best commercial property insurance:

- Work with an Experienced Insurance Broker: An experienced insurance broker can guide you through the process and help you find the most suitable policy for your business.

- Conduct a Risk Assessment: Identify the potential risks and vulnerabilities associated with your property and choose an insurance policy that adequately covers those risks.

- Review Policy Terms and Conditions: Carefully read and understand the terms and conditions of the insurance policy to ensure it meets your business requirements.

- Seek Recommendations: Consult with other business owners or industry experts to get recommendations on reliable insurance providers.

- Regularly Review and Update Coverage: As your business grows and evolves, regularly review and update your commercial property insurance coverage to ensure it remains adequate.

6. Common FAQs about Commercial Property Insurance

What does commercial property insurance cover?

Commercial property insurance covers property damage and loss caused by fire, theft, vandalism, natural disasters, and other covered perils. It also provides coverage for business interruption and liability.

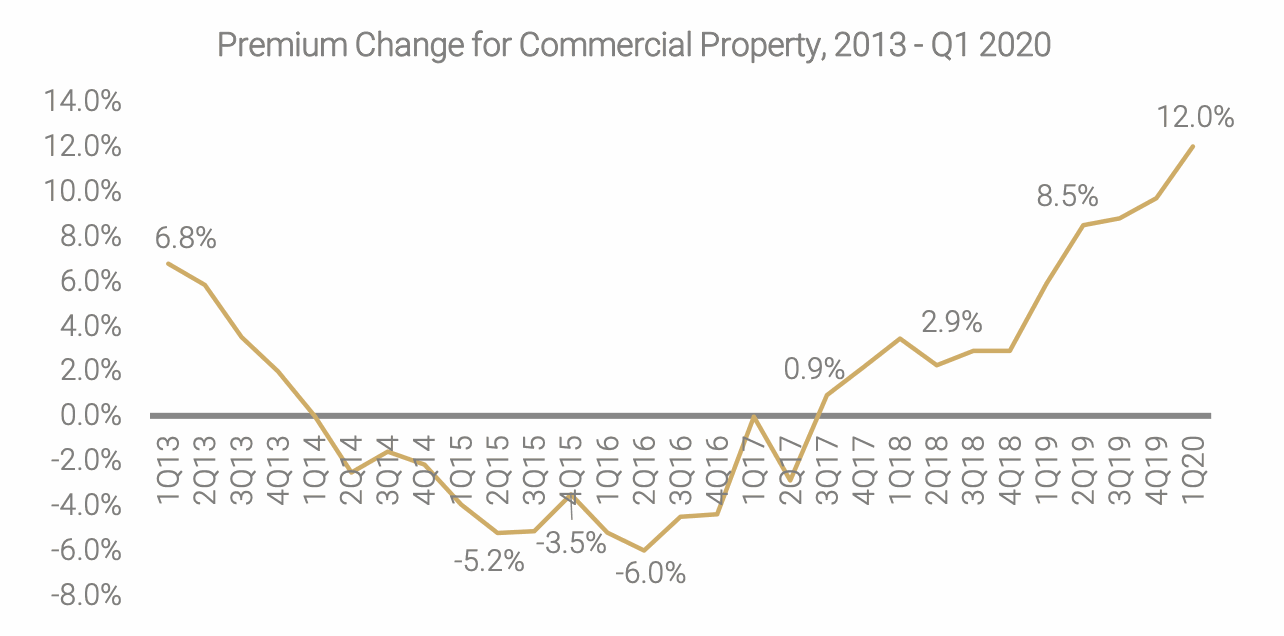

How much does commercial property insurance cost?

The cost of commercial property insurance varies depending on factors such as the value of the property, location, coverage limits, deductible amount, and the type of business.

Is flood damage covered by commercial property insurance?

Flood damage is typically not covered under standard commercial property insurance. However, separate flood insurance policies are available to provide coverage for flood-related damages.

Can I bundle commercial property insurance with other business insurance policies?

Yes, many insurance providers offer the option to bundle commercial property insurance with other business insurance policies, such as general liability or commercial auto insurance, to obtain comprehensive coverage at a discounted rate.

How do I file a claim for commercial property insurance?

In the event of property damage or loss, contact your insurance provider immediately to initiate the claims process. Provide them with all necessary documentation and information to support your claim.

6. Conclusion

Commercial property insurance is a vital investment for businesses, providing protection against property damage, theft, and other unforeseen incidents. By carefully considering factors such as coverage options, premiums, and additional coverage, businesses can select the best commercial property insurance for their specific needs. Remember to regularly review and update your coverage to ensure ongoing protection for your valuable assets. Please read other finance articles on this blog here